Well now, if y’all been payin’ any attention to the news about LifeStance Health Group, you probably heard they’ve been goin’ through a bit of a rough patch lately. There’s been a lotta talk ‘bout their stock prices and how the company’s been doin’ on the financial side of things. But don’t you worry, I’m here to break it all down for ya, in plain ol’ speak, like we’re settin’ out on the porch talkin’ over some sweet tea.

What’s LifeStance Health All About?

Now, let me start with the basics. LifeStance Health, they’re based out in Scottsdale, Arizona, and they work on providing outpatient mental health services. That means they help folks with their mental well-being without havin’ to stay in the hospital. They got doctors, counselors, and therapists workin’ with people who need help with everything from anxiety to depression. So, in short, they do a lotta good for the community.

Stock Prices Ain’t Lookin’ Too Hot

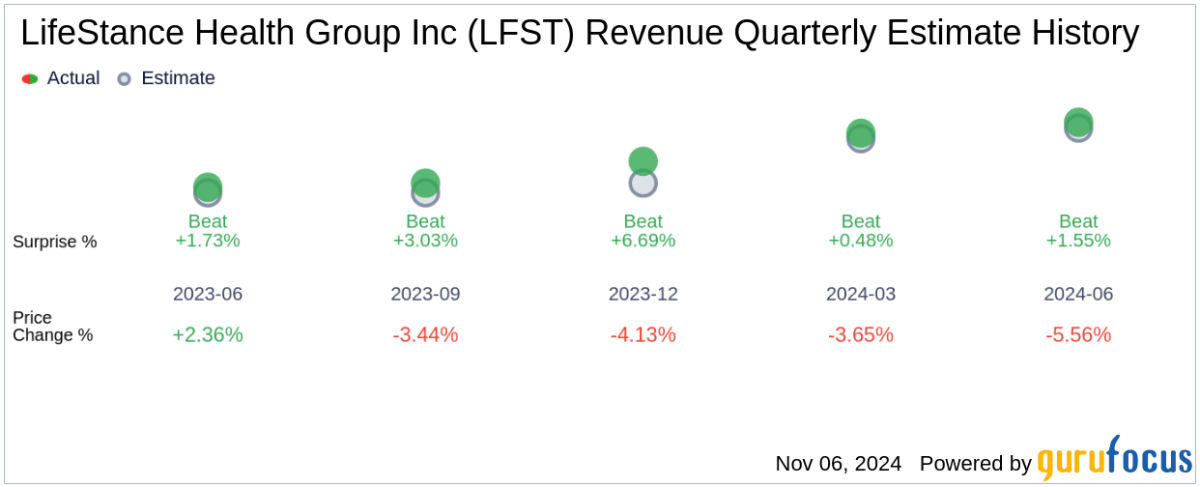

But, I reckon, the stock prices for LifeStance haven’t been too rosy. They got them analysts out there givin’ their predictions and, well, they ain’t so optimistic right now. The average price target for the stock is sittin’ at about $8.25. Some folks are hopin’ it’ll rise to $10, but right now it’s just been driftin’ down. And this has got investors a bit concerned. Y’know how it goes, when the stock drops, people start talkin’ and wonderin’ what’s goin’ on.

Financial Struggles and Losses

So, here’s the deal: LifeStance has also been dealin’ with some tough financial news. For the nine months ended September 30, 2024, they reported about $44.9 million in cash flow from operations. That sounds like a lotta money, but when you’re a big company, it’s not all sunshine and rainbows. They also reported a loss of $0.02 per share in their most recent quarter, which was better than the loss of $0.07 that some folks were expectin’. But still, a loss is a loss. You can’t sugarcoat it, no matter how ya look at it.

Leadership Changes and the Challenges Ahead

On top of all that, LifeStance is dealin’ with some leadership changes. One of their top execs, a feller by the name of Danish Qureshi, is leavin’, and they’re tryin’ to find someone to fill his shoes. Now, when you lose a big shot like that, it’s not always easy to find someone who can step up and keep things runnin’ smooth. So, that’s somethin’ they gotta figure out if they wanna keep pushin’ forward.

The Road Ahead: Will They Bounce Back?

As for what’s comin’ next for LifeStance Health, well, that’s anyone’s guess. They ain’t gonna end the year with cash flow positive like they once hoped, which is a real shame. And on top of that, they’ve said they’ll keep away from mergers and acquisitions for the time bein’. That means they won’t be tryin’ to buy up other companies or get bought out themselves. So, what’s next? Well, we’ll just have to wait and see how they handle these challenges. Can they turn it around? Or will the rough times keep draggin’ them down?

What Investors Need to Know

If you’re thinkin’ about investin’ in LifeStance or already have, now’s a good time to keep a close eye on ‘em. They’re in a bit of a tough spot right now, with their stock takin’ a hit and leadership changes on the horizon. But that don’t mean it’s all doom and gloom. Sometimes companies can come back stronger after a rough patch, but you gotta stay informed and keep watchin’ what they do next.

Wrapping Up

So, to sum it all up, LifeStance Health Group is in a bit of a bind right now. Their stock ain’t doin’ too hot, they’re dealin’ with some losses, and they’ve got some leadership changes on the way. But like I said before, who knows what the future holds? We’ll just have to wait and see how things play out for ‘em.

Tags:[LifeStance Health, LFST, stock news, financial update, leadership changes, mental health services, stock target, company losses, investment tips]